What are company filings?

Company filings are also called SEC filings, which are regulatory documents that public companies, certain company insiders, and broker-dealers must file periodic financial statements and other disclosures and submit them to the Securities and Exchange Commission (SEC) on a regular basis. Investors and finance professionals rely on SEC filings to make informed decisions when evaluating whether to sell, buy, or hold a company’s stocks.

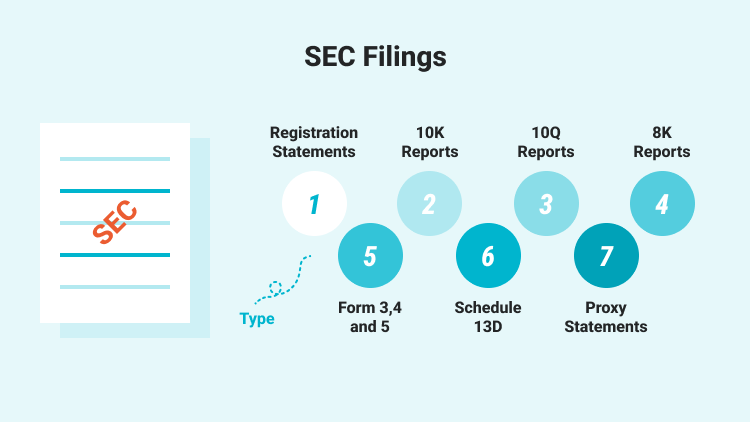

Types of SEC filings

The SEC selectively reviews the information it receives to monitor and enhance compliance. Investors study these filings to form a view of a company's performance and activities. The following are the most common types of SEC filings:

1. Form 10-K

A 10-K is a comprehensive report filed annually by a domestic issuer about an overview of the company's business and financial condition and audited financial statements. Compared to the annual report, the 10-K is generally more detailed than the annual report but lacks photos and graphics.

2. Form 10-Q

A 10-Q contains a company’s results by quarter, allowing comparison between a company’s previous fiscal quarter and its current fiscal quarter. In the 10-Q, companies are required to disclose relevant information regarding their finances as a result of their business operations. The form is generally an unaudited report, and it must be filed for each of the first three fiscal quarters of the company's fiscal year.

3. Form 8-K

Form 8-K is known as a “current report” and it is the report that companies must file with the SEC to announce material events relevant to shareholders, such as the bankruptcy of an entity, the completion of an acquisition, the delisting of stock, etc.

4. Proxy statement

The proxy statement, called a Form DEF 14A, is a document the SEC requires companies to send to shareholders to inform them of upcoming shareholder meetings. In the proxy statement, investors can find out the salaries of the management of a company and any other perks that a company's management is eligible for.

5. Form 3, 4, and 5

Corporate insiders must file Forms 3, 4, and 5. The SEC defines a corporate insider as a company's officers and directors, and any beneficial owners of more than 10% of a class of the company's equity securities. These forms are meant to reveal more information about the securities that company insiders own.

- Form 3 is the initial filing and discloses ownership amounts.

- Form 4 is required to be filed by a company or the individual at the company when there is a change in the holdings of company insiders.

- Form 5 is filed if a person conducted a trade of the company's stock but failed to report it via Form 4.

6. Form S-1

A company preparing to offer securities to the public for the first time will file a Form S-1 registration statement with the SEC. The statement must include a prospectus, which provides details about the company's management, business operations, financial health, operational results, risk factors, and other pertinent information.

7. Form S-4

Form S-4 is filed by a publicly traded company to register any material information related to a merger or acquisition.

8. Schedule 13D

Anyone who purchases more than 5% of a company’s publicly traded securities must submit a Schedule 13D to the SEC.

9. Form 20-F

Form 20-F is an annual report filing for non-U.S. and non-Canadian companies that have securities trading in the U.S. For example, when Alibaba Group announces the filing of annual reports, they have to fill out Form 20-F.

Where to find public company filings and reports?

Public company filings are an important source of data and information for investors. Knowing where to find this information is a critical first step in performing stock analysis. The following are the most common sources of public company filings.

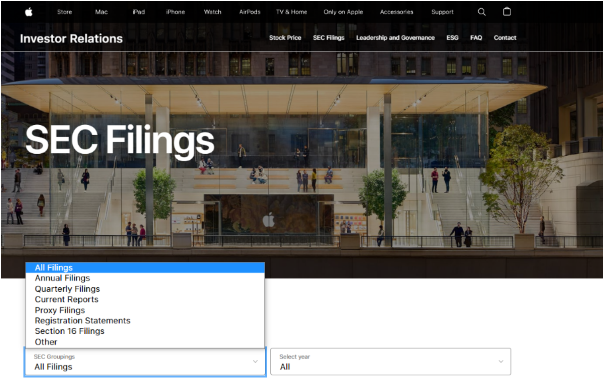

1. Investor Relations (IR) on Corporate Websites

Companies will provide their most recent documents including their annual report, 10-K, quarterly reports, news releases, and corporate presentations. So the easiest way to find information on public companies is to perform a Google search for their investor relations website. Let’s use Apple Inc. as an example, and the details are shown as below:

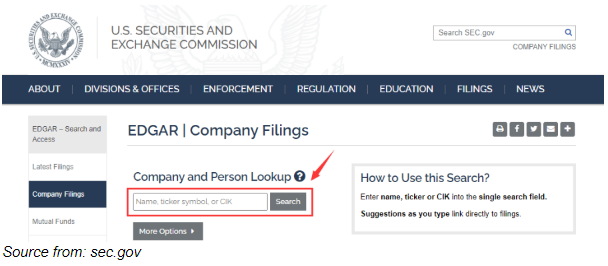

2. EDGAR

EDGAR, the Electronic Data Gathering, Analysis, and Retrieval system, is the primary system for companies and others submitting documents under SEC. Investors can find company filings by using the SEC’s database EDGAR. All publicly traded foreign and domestic companies are required to file registration statements, periodic reports, and other forms electronically through EDGAR, and anyone can access and download this information for free. Investors have two steps of accessing EDGAR from the SEC.gov home page:

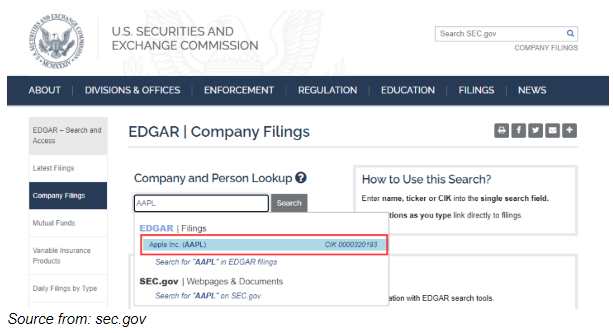

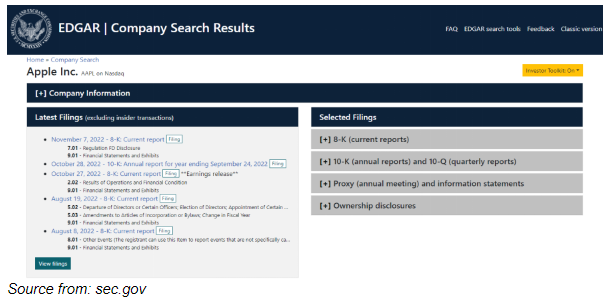

EDGAR presents search results in a chronological order and identifies the filings by form types, shown in the first column of the search results. For example, the form type for the annual report on Form 10-K filed by domestic public companies is “10-K”. Let‘s use Apple Inc. as an example. Details are shown as below:

Summary:

- SEC Filings are regulatory documents that companies and issuers of securities must submit to the Securities and Exchange Commission (SEC) on a regular basis. The purpose is to provide transparency and information to investors, analysts, and regulators.

- Form 10-K is an annual business disclosure report all publicly traded companies are legally required to file with the SEC and make available to investors.

- Form 10-Q is a financial report that publicly traded companies are required to file after each of the first three quarters of the year.

- Form S-1 is a document that companies must file with the SEC before going public in the US.

- The EDGAR database provides free public access to corporate information, allowing investors to research a public company’s financial information and operations by reviewing the filings the company makes with the SEC.