In the last class, we mentioned that over the past two years, investing in IPOs in the Saudi market had a 73% success rate. This is quite a high number! Why is it that such seemingly easy investments can be so profitable? And how long can this effortless money-making opportunity last?

Let's address the first question, which can be attributed to the following three reasons:

Reason 1: Limited Supply Fuels Saudi IPO Frenzy

First, the number of new stock issuances is too low. In the past two years, only 26 companies have gone public through an IPO on the Saudi main market. This number is quite small. In contrast, in 2023 alone, the US stock market saw 162 new stocks listed, far surpassing the Saudi stock market. Therefore, the scarcity of supply is an important reason why Saudi IPOs are highly sought after.

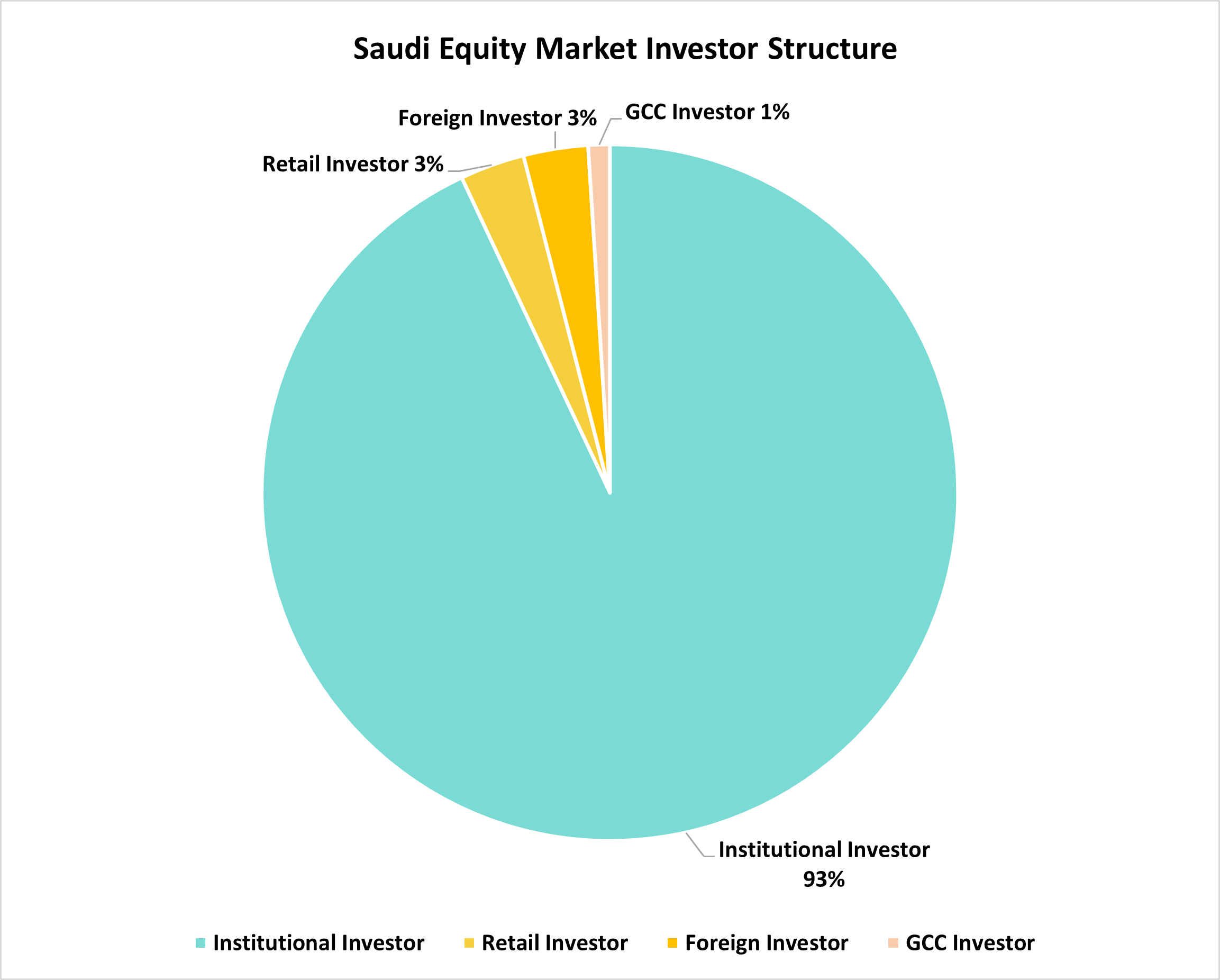

Reason 2: Unique Investor Structure: Institutional Dominance vs. Individual Volatility

Second, the unique investor structure. As of Q3 2023, local institutional investors held 93% of the ownership value in the Saudi stock market, while individual investors and foreign investors each accounted for about 3%. Institutional investors mostly allocate to large-cap blue-chip stocks, such as Saudi Aramco, and they do not like to trade frequently, which does not provide liquidity to the market. Foreign investors, although relatively more professional and mature, have too low a share to impact the market significantly. Individual investors are more concerned with short-term price fluctuations, so they prefer new stocks with high liquidity and volatility.

Reason 3: Government Initiatives Fuel Saudi IPO Valuations

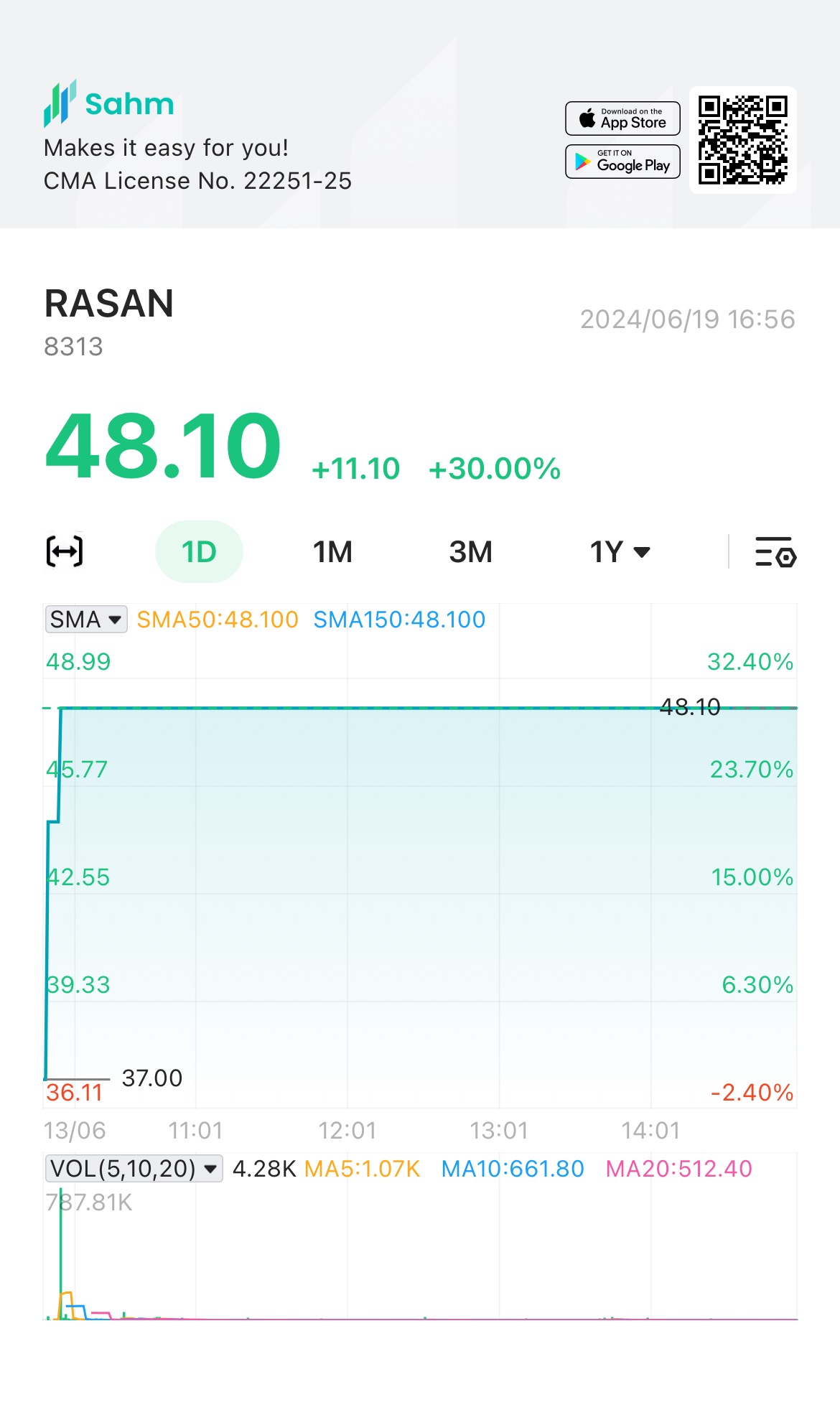

Third, the Saudi government is actively promoting economic transformation. Some new economy companies might receive preferential policies and higher valuations as part of this effort. For example, the fintech industry is one of the emerging sectors that the Saudi government is vigorously promoting. Rasan is one of the few fintech companies in Saudi Arabia, and its IPO was highly sought after by investors. Investors subscribed to $29 billion worth of shares, oversubscribing by 129 times. On its first day of trading, Rasan's stock surged to as high as 48.1 riyals, representing a 30% increase from its IPO price of 37 riyals per share (the maximum allowed increase).

Will the IPO Profit Boom Endure?

Finally, let's discuss how long the benefits of investing in Saudi IPOs can last. Based on the experience of other capital markets, the golden period should last for a few more years until the government decides to adopt a registration-based system for listings, leading to an increase in the number of IPOs and a reduction in supply scarcity. Additionally, as the proportion of foreign investors gradually increases and liquidity improves, the fundamentals of companies will become the core value, and the success rate of IPO investments will decline. At that time, only IPOs with reasonable pricing and strong fundamentals will be able to rise. Therefore, investing in IPOs currently represents a period of opportunity, and everyone should seize the time to study and research.