There are some key terms in an option contract that investors must be familiar with before going further in this section. The most important elements of an option contract are:

1. Underlying asset

Underlying assets are the financial assets upon which a derivative’s price is based, and the value of the underlying asset drives the value of the financial derivative. Options are an example of a derivative, so an underlying asset refers to the asset to be exchanged if the option is exercised. Meanwhile, options contracts have an underlying product such as stocks, ETFs, commodities, etc. For instance, let’s say there is an option contract for Apple stock, and it offers an investor the right to purchase or sell the stock at the strike price until its expiration date. In this situation, Apple stock becomes the underlying asset.

2. Option type

There are two basic types of options: Calls and Puts.

- A call option is a right to “buy” the underlying product at a predetermined price.

- A put option is a right to “sell” the underlying product at a predetermined price.

Before establishing your option position, you will need to carefully consider your financial strategy and objectives. Whether you are hedging or pursuing a trading strategy, close alignment of the contract details is important to achieving desired results from your option position.

3. Strike price (exercise price)

The strike price is also called the exercise price, which refers to the price at which the owner of the option can buy or sell the underlying security if they decide to exercise the contract. Basically, the strike price is the anchor price at which the two parties (buyer and seller) agree to enter into an options agreement. For call options, the strike price is where the security can be bought by the option holder; for put options, the strike price is the price at which the security can be sold.

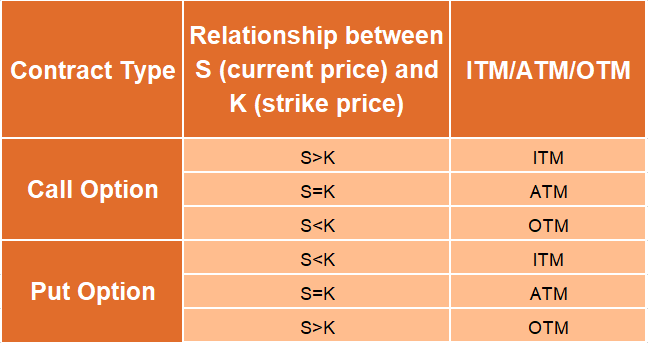

Additionally, the difference between the exercise price and the underlying asset’s price determines the types of strike prices. There are three types of the strike price, as seen below:

- In-the-money (ITM): An in-the-money call option means the option holder can buy the security below its current market price. An in-the-money put option means the option holder can sell the security above its current market price.

- At-the-money (ATM): ATM is an option with a strike price at or very near to the current market price is known as at-the-money. ATM options are often the most liquid and active options traded in a name.

- Out-of-the-money (OTM): A call option is OTM if the underlying price is trading below the strike price of the call. A put option is OTM if the underlying price is above the put's strike price.

4. Expiry date

Expiry Date refers to the date on which the option contract, and hence the right to exercise, will expire. The expiration date for listed stock options in the United States is normally the third Friday of the contract month or the month that the contract expires. On the expiry date, you are not bound to fulfill the contract. As such, if the contract is not acted upon within the expiry date, it simply expires. The premium that you paid to buy the option is forfeited by the seller, and you don’t have to pay anything else.

5. Exercise style

Exercise Style refers to when the option contract can be exercised. There are two styles, European and American. European style options can only be exercised on the expiry date, while American style options can be exercised at any time on or before expiry. The exercise style for the stock option contracts and index option contracts traded on the Exchange is American style and European style respectively. Most equity options are American-style options; many broad-based equity indices, including the S&P 500, have actively traded European-style options.

6. Contract size

The term contract size refers to the deliverable quantity of a stock, commodity, or financial instrument that underlies an options contract. In the United States, options contracts usually represent 100 shares of the underlying security. The buyer pays a premium fee for each contract. For example, if an option has a premium of $1 per contract, buying one option costs $100. The premium is partially based on the strike price or the price for buying or selling the security until the expiration date.

Summary:

- Underlying assets are the financial assets upon which a derivative’s price is based, and the value of the underlying asset drives the value of the financial derivative.

- The two basic types of options are: Calls and Puts. Call options give the buyer the right to buy the underlying asset. Put options give the buyer the right to sell the underlying asset.

- The strike price is also called the exercise price, which refers to the price at which the owner of the option can buy or sell the underlying security if they decide to exercise the contract.

- There are three types of the strike price which are in-the-money, at-the-money and out-of-the-money.

- Expiry Date refers to the date on which the option contract, and hence the right to exercise, will expire.

- Exercise Style refers to when the option contract can be exercised. There are two styles, namely European and American.

- The term contract size refers to the deliverable quantity of a stock, commodity, or financial instrument that underlies an options contract.