ETFs are often viewed as a more affordable option compared to buying stocks individually, as they provide investors with the opportunity to invest in a basket of companies according to their risk profiles. Even if ETFs can be relatively inexpensive, investing in them does include certain costs. Here are the fees for investing in ETFs:

1. Operating expense ratio

Operating expense ratio(OER), also known as expense ratio, is the amount that an investment company charges investors to manage an investment portfolio. It represents all of the management fees and operating costs of the fund. The expense ratio is an annual rate the fund (not your broker) charges on the total assets it holds to pay for portfolio management, administration, and other costs.

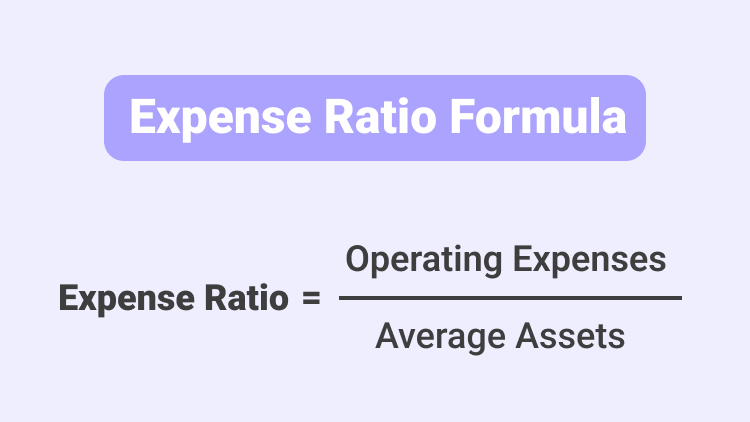

A fund's expense ratio equals the fund's operating expenses divided by the average assets of the fund.

For example, let’s say you invest $10,000 in Invesco QQQ ETF, which, according to the fund, has a current expense ratio of 0.2%. You will pay $20 (10,000 * 0.2%) this year and increased amounts in following years, assuming the value of your investment continues to grow. If the fund's value increases by 10% annually for the next year, then your initial investment will be worth $11,000. Over a year, you would pay fees totaling $22.

2. Commission costs

Unlike other investments, many investors can trade listed ETFs online commission-free, such as Sahm. Therefore, commission costs aren't as important of a consideration as they have been in the past. However, you'll still want to check with your broker for commission costs, which can range from $0 to $25 or more.

3. Bid/ask spreads

Other than the operating costs of an ETF, the other hidden cost that affects the return for investors is the bid-ask spread. “Bid” is the price someone’s willing to pay for an investment vehicle like an ETF at a specific point in time. “Ask” is the price someone’s willing to offer for a sale. The difference between these two prices is commonly known as the bid/ask spread. The most important takeaway here is that the wider the spread, the more expensive it is to trade that ETF.

4. Discounts and premiums to NAV

Net Asset Value(NAV) is the net value of an investment fund's assets less its liabilities, divided by the number of shares outstanding.

● Premium to NAV is a pricing situation that occurs when the value of an ETF is trading at a premium to its daily reported accounting NAV. Funds trading at a premium will have a higher price than their comparable NAV.

● A premium to NAV is most often driven by a bullish outlook on the securities in a fund, as investors are generally willing to pay a premium because they believe securities in the portfolio will end the day higher.

● Discount to NAV is a pricing situation that occurs when an ETF’s market trading price is lower than its daily NAV. A discount to NAV is most often driven by a bearish outlook on the securities in a fund.

For example, imagine an ETF that trades in the market at $50 per share. If the individual stocks the ETF holds are worth only $49.90 per fund share, then the ETF is trading at a premium of 0.2%. Conversely, if the stocks the ETF holds are worth $50.25 per fund share, the ETF is trading at a discount of 0.5%.

In general, most ETFs exhibit small discounts and premiums. When material differences do manifest in ETF prices, large institutional investors usually help the market self-correct by attempting to profit from arbitrage trades that serve to better align an ETF's market price and NAV.

Summary:

- The operating expense ratio(OER), also known as the expense ratio, represents all of the management fees and operating costs of the fund.

- A fund's expense ratio equals the fund's operating expenses divided by the average assets of the fund.

- Unlike other investments, many investors can trade listed ETFs online commission-free.

- Other than the operating costs of an ETF, the other hidden cost that affects the return for investors is the bid-ask spread. The most important takeaway here is that the wider the spread, the more expensive it is to trade that ETF.

- A premium to NAV is most often driven by a bullish outlook on the securities in a fund, as investors are generally willing to pay a premium because they believe securities in the portfolio will end the day higher.

- Discount to NAV is a pricing situation that occurs when an ETF’s market trading price is lower than its daily NAV. A discount to NAV is most often driven by a bearish outlook on the securities in a fund.