A circuit breaker is an emergency-use regulatory measure that halts trading to curb panic-selling for a certain period on an exchange. Even though the US stock market has no price limit up and down, circuit breakers are triggered when a stock experiences a large percentage swing in either direction or a market index experiences a devastating decline.

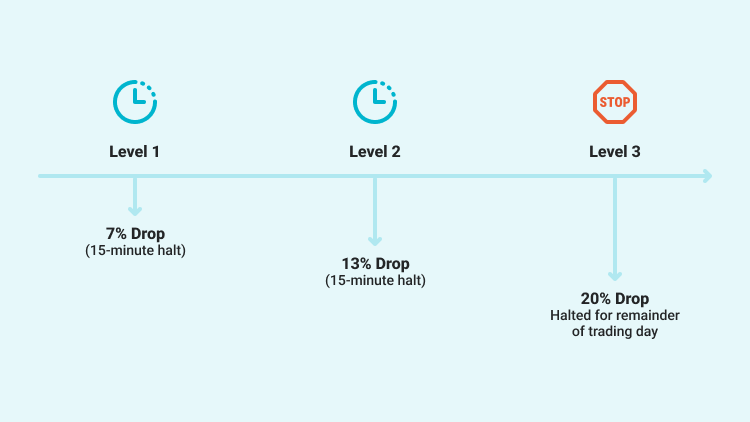

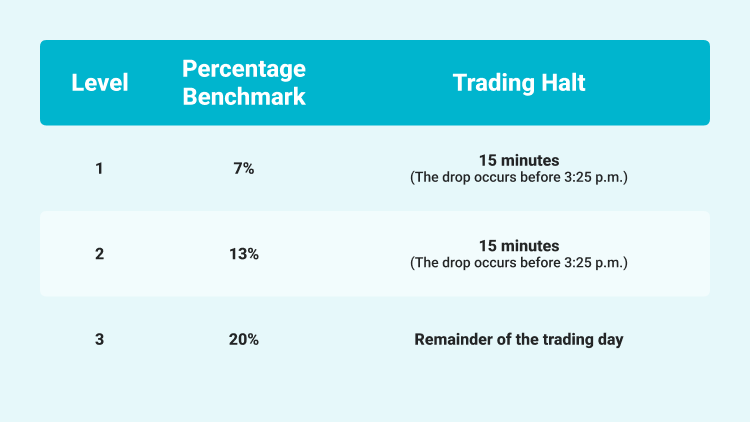

The market index percentage changes were split into three tiers, which are set at 7% decline, 13% decline and 20% decline of the closing price for the previous day respectively. As seen below:

A market decline that triggers a Level 1 or Level 2 circuit breaker before 3:25 p.m. will halt trading for 15 minutes, while a similar market decline “at or after” 3:25 p.m. will not halt market-wide trading. A market decline that triggers a Level 3 circuit breaker, at any time during the trading day, will halt market-wide trading for the remainder of the trading day.

The first market-wide circuit breaker was put into place after Black Monday on Oct. 19, 1987, when the Dow Jones Industrial Average dropped nearly 23% in one day. The recent circuit breakers were triggered on March 9, March 12, March 16, and finally on March 18, 2020, in response to the severity of the growing global coronavirus pandemic.