What is option price?

Options prices, also known as premiums, are the price the buyer of the options contract pays for the right to buy or sell a security at a specified price at a later date. Option pricing can be complicated, as it depends on several key factors. Understanding how to value that premium is crucial for trading options and essentially rests on the probability that the right or obligation to buy or sell a stock will end up being profitable at expiration. So buyers of an option pay the premium, and sellers of an option receive the premium. Here, we unwrap the two key principles of how options’ premiums are derived.

What are the intrinsic value and time value of an option?

A premium is primarily made up of two distinct parts: intrinsic value and time value. They are two major determining factors of the value of an options contract.

1. Intrinsic value

The intrinsic value of an option can be used to determine how much an option or an asset is worth, and it is the price difference between the current stock price and the strike price. The price to buy or sell an option is called the strike price and is determined ahead of time when the contract is executed.

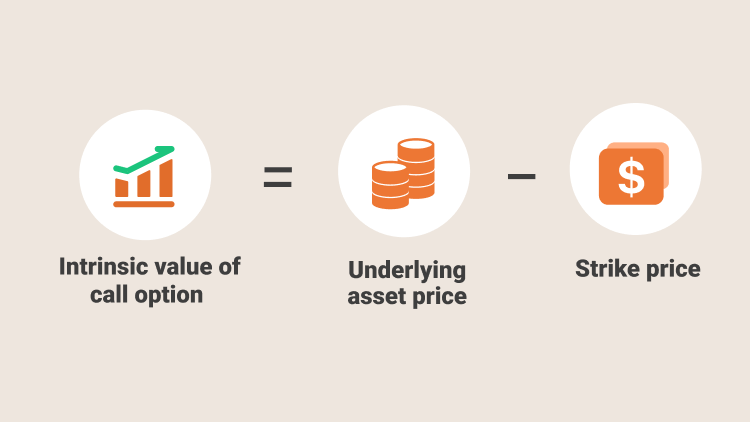

- To calculate the intrinsic value of a call option:

For example, imagine that Apple stock is selling at $100. A call option for Apple with a strike price of $90 would have an intrinsic value of $10 ($100 - $90= $10). In this case, option holders could exercise the option to buy Apple shares at $90, then immediately sell the stocks for a $10 profit in the market. The contract would be in the money at $10.

But what if the strike price is higher than the $100 market price of Apple stock? Let’s say the call option strike price is $105 ($105 – $100 = –$5). The option would be considered out of the money and worth zero because the intrinsic value of an option can never be negative.

- To calculate the intrinsic value of a put option:

For example, with the underlying price of $100 for Apple stock, a put option with a strike price of $90 would have an intrinsic value of zero ($90 - $100= -$10), again because the value of an option cannot fall below zero. However, a put option with a strike price of $110 would be considered in the money, and have an intrinsic value of $10 ($110 – $100 = $10).

Investors should notice when calculating options strategies that an option’s intrinsic value does not include the premium the investor has to pay in order to buy the options contract in the first place. Therefore, it’s important to include that initial premium when investors want to get a better sense of the profit of an options trade.

2. Time value

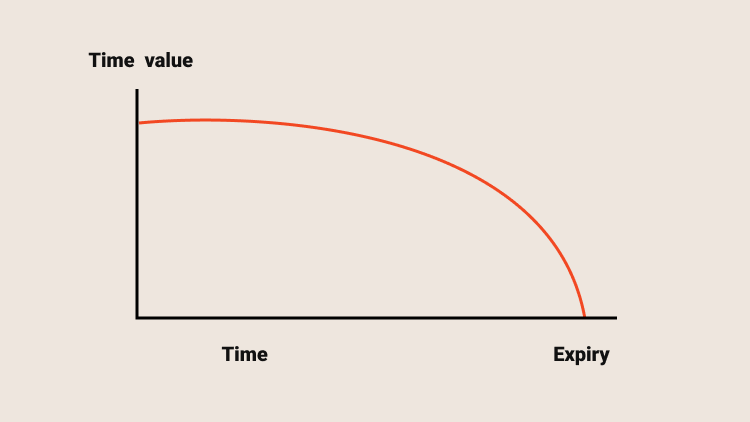

Time value in options pricing refers to the contract’s extrinsic value. As options contracts have a finite amount of time before they expire, the time remaining until an option's expiration therefore has a monetary value associated with it, which is known as time value.

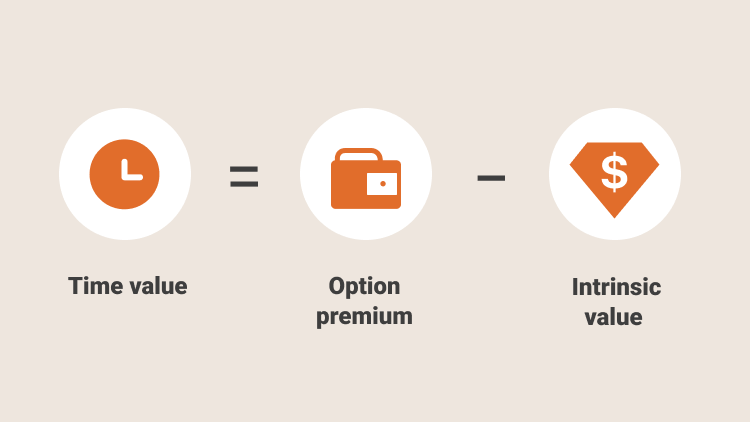

The time value of an option is based on the expected volatility of the underlying asset’s price and the time until the option's expiration date. The more time an investor in an options contract has, the better their chances of being able to exercise that option in the money, simply because the underlying security has a greater chance of moving in the desired direction. Longer time periods come with a greater possibility for profit. Conversely, as an options contract gets closer to expiring, its value goes down. The reason is that there is less time for the security underlying the options contract to make profitable moves. The formula for the time value of an options contract:

When an option reaches expiration, there is no time remaining and the time value is zero. This means the value at expiration is either zero, if the option is at or out of the money, or its intrinsic value if it is in the money. For example, if Apple is trading at $100 and the one-month-to-expiration Apple 90 call option is trading at $11.5 (premium), the time value of the option is $1.5 ($11.5 - $10 = $1.5).

Meanwhile, with Apple trading at $100, an Apple 90 call option trading at $14 with nine months to expiration has a time value of $4 ($14 - $10 = $4). Notice the intrinsic value is the same; the difference in the price of the same strike price option is the time value.

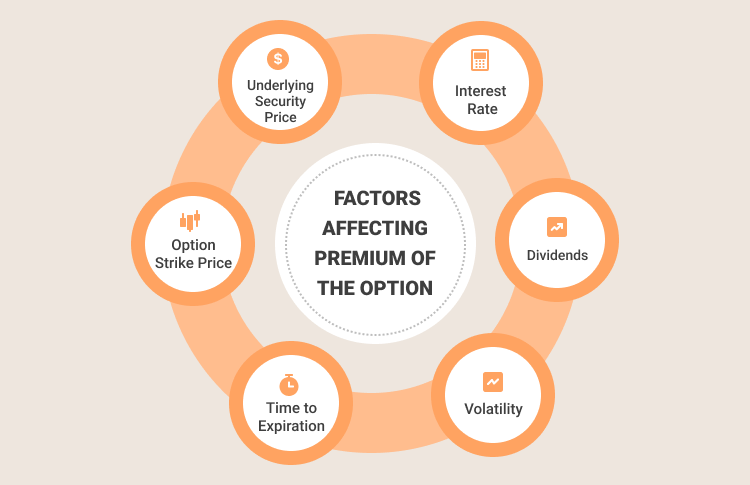

What are the factors that determine option prices?

1. Price of the underlying asset

For call options, the higher the price of the underlying, the greater its intrinsic value and the higher the price of the option. Conversely, the lower the price of the underlying, the less its intrinsic value and the lower the value of the call option. In general, call option values increase when the value of the underlying asset increases. However, an increase in the price of the underlying reduces the value of a put option.

2. The strike price

A higher strike price decreases the value of call options and a lower strike price increases the value of call options. In contrast, a higher strike price increases the values of put options and a lower strike price decreases the values of put options.

3. The risk-free rate

The risk-free rate represents the interest an investor would expect from an absolutely risk-free investment over a specified period of time. An increase in the risk-free rate will increase call option values, and a decrease in the risk-free rate will decrease call option values. An increase in the risk-free rate will decrease put option values, and a decrease in the risk-free rate will increase put option values.

4. Volatility of the underlying asset

Volatility is what makes options valuable. If there were no volatility in the price of the underlying asset (its price remained constant), options would always be equal to their intrinsic values, and time or speculative value would be zero. An increase in the volatility of the price of the underlying asset increases the values of both put and call options and a decrease in the volatility of the price of the underlying decreases both put and call values.

5. Time to expiration

Since volatility is expressed per unit of time, a longer time to expiration effectively increases expected volatility and increases the value of a call option. Less time to expiration decreases the time value of a call option so that at expiration its value is simply its intrinsic value. For most put options, a longer time to expiration will increase option values for the same reasons. However, some European put options extending the time to expiration can decrease the value of the put.

6. Costs and benefits of holding the asset

If there are benefits to holding the underlying asset (dividend or interest payments on securities), call values are decreased and put values are increased. This is because when a stock pays a dividend, or a bond pays interest, this will reduce the value of the asset. Decreases in the value of the underlying asset decrease call values and increase put values.

Summary:

- Options prices, also known as premiums, are the price the buyer of the options contract pays for the right to buy or sell a security at a specified price at a later date.

- The intrinsic value of an option can be used to determine how much an option or an asset is worth, and it is the price difference between the current stock price and the strike price.

- The formula for calculating the intrinsic value of a call option is to use the underlying asset price minus the strike price. The formula of put options is to use strike price minus underlying asset price.

- Time value in options pricing refers to the contract’s extrinsic value. The time value of an option is based on the expected volatility of the underlying asset’s price and the time until the option's expiration date.

- The formula for the time value of an options contract is to use option premium minus the intrinsic value.

- When an option reaches expiration, there is no time remaining and the time value is zero. This means the value at expiration is either zero, if the option is at or out of the money, or its intrinsic value if it is in the money.

- There are six factors that determine option premium, which include underlying asset price, strike price, risk-free rate, volatility of the underlying asset, time to expiration, and costs and benefits of holding the asset.