How are prices determined on a stock market?

The primary role of a stock market is to attract buyers and sellers to negotiate stock trading. To determine the price, auctions are the most common way of setting the prices of a share. Buyers offer a “bid,” or the highest amount they’re willing to pay, which is usually lower than the amount sellers “ask” for in exchange.

- Bid: The bid price is the price that an investor is willing to pay for the stock, and it represents the highest price that someone is willing to pay for the stock.

- Ask: The ask price is the price that an investor is willing to sell the security for, and it also means the lowest price someone is willing to sell the stock for.

The difference between the bid and the ask is called the spread. For a trade to occur, a buyer needs to increase his price or a seller needs to cut the price. For example, if the current stock quotation includes a bid of $10 and an ask of $10.20, an investor looking to purchase the stock would pay $10.20 while an investor looking to fold would sell it at $11.

As a retail investor, when buying a stock, you’ll see the bid, ask, and bid-ask spread on your broker's website, but in many cases, the difference will be pennies and won’t be of much concern for investors.

The US stock trading sessions

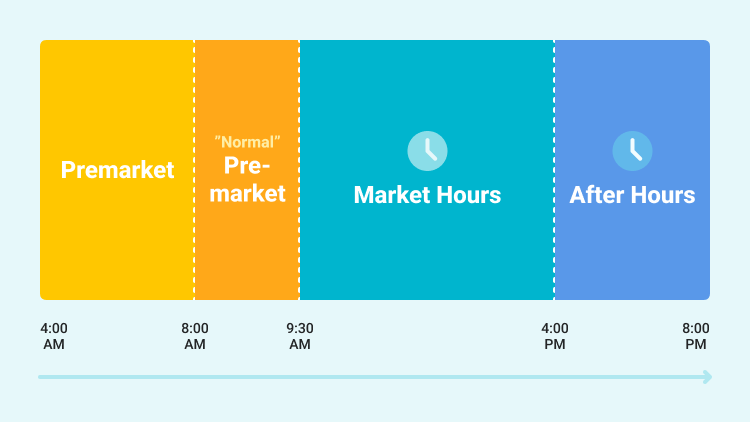

The regular trading hours for the U.S. stock markets, including the New York Stock Exchange (NYSE) and the Nasdaq Stock Exchange (Nasdaq). Both stock exchanges open Monday through Friday from 9:30 AM to 4:00 PM Eastern Daylight Time (GMT-04:00), and they don’t close for lunch, opening for a total of 6 hours 30 minutes per day.

- Eastern Standard Time (EST): EST is observed during the autumn and winter months in New York and other cities in the U.S. It is five hours behind the Greenwich Mean Time(GMT)/Coordinated Universal Time or UTC-5.

- Eastern Daylight Time (EDT): In summer and spring seasons, daylight saving time is observed in the US. EDT is four hours behind UTC or UTC-4.

Pre-market trading & Extended-hours trading

1. Pre-market trading

Pre-market trading typically occurs between 8 a.m. and 9:30 a.m., when investors make trades before the opening bell for major US exchanges. For example, if an investor places a limit order in the pre-market to buy 100 shares of Apple at $100 per share, and there is no sell order for Apple on the electronic communication networks (ECN). In this case, the investor’s buy order will not immediately execute. If no one is willing to sell shares at the price he/she wants to buy them for, the investor may have to wait until there is a match for his/her price, which may not happen. (Note: ECNs are computerized trading systems, which display and match orders directly between buyers and sellers.)

As pre-market trading allows for an early jump on reactions to the news, investors can look for opportunities to get ahead of the market, especially if earning reports are being released on the trading day. But during the pre-market, there is less trading volume and less competition. Sometimes, there may be no buyers or sellers to fill an order. Fewer buyers and sellers also mean a wider variation in prices or higher volatility.

2. Extended-hours trading

After-hours trading starts at 4 p.m. and can run as late as 8 p.m. ET., which is something traders or investors can do if news breaks after closing. The changes in share prices during the after-hours are a valuable barometer of the market reaction to the new information released.

Extended trading hours can offer some benefits to investors, as they can use this time to quickly respond to business news or changes in the market. For example, if a company announces a surprisingly favorable earnings after hours, it could create a demand for shares and a subsequent bump in the company's stock price. However, if there are fewer market participants in after-hours sessions, there will be limited liquidity for most stocks, which would cause large spreads and increased volatility.

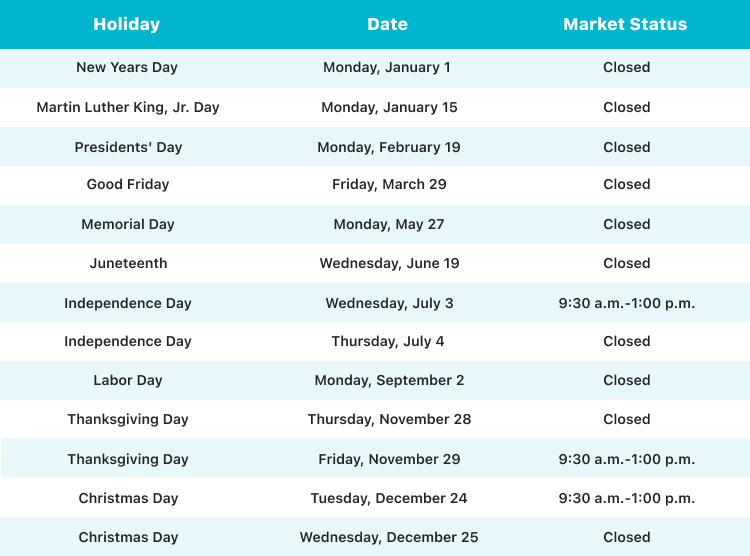

2024 U.S. Market Holidays

NYSE and Nasdaq exchanges both are closed for ten days in 2024, and the market has three irregular schedules or half-days.

Summary:

- Auctions are the most common way of setting the prices of a share. Buyers offer a “bid,” or the highest amount they’re willing to pay, which is usually lower than the amount sellers “ask” for in exchange.

- NYSE and Nasdaq stock exchanges open Monday through Friday from 9:30 AM to 4:00 PM Eastern Daylight Time (GMT-04:00), and they don’t close for lunch, opening for a total of 6 hours 30 minutes per day.

- Pre-market trading typically occurs between 8 a.m. and 9:30 a.m., when investors make trades before the opening bell for major US exchanges.

- After-hours trading starts at 4 p.m. and can run as late as 8 p.m. ET., which is something traders or investors can do if news breaks after closing.