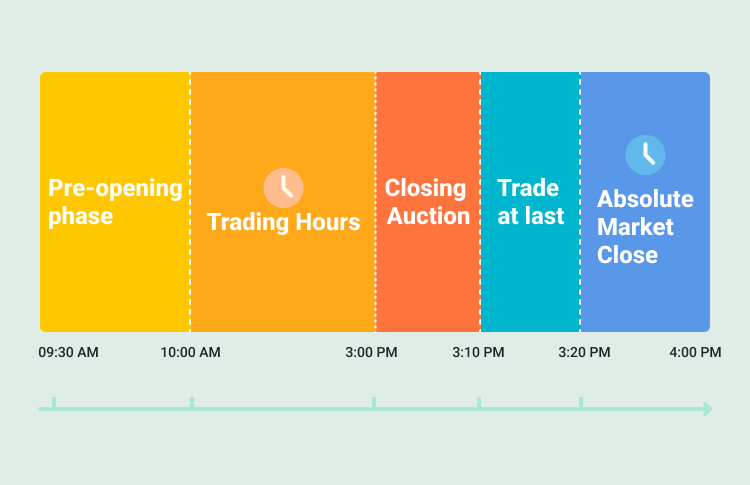

The Saudi Stock Exchange opens Sunday through Thursday from 10:00 am to 3:00 pm Arabian Standard Time (GMT+03:00). The exchange does not close for lunch, and it opens for a total of 5 hours per day.

1. Pre-Open session

During the first of the four market states:

- Orders can be entered, amended, or canceled

- No matching occurs, orders are only held in the order book

- Auction mechanism to calculate the opening and closing price

2. Open-Trading session

During this state, all functions in the preceding state are allowed in addition to:

- Opening prices are determined, orders are matched and continuous trading commences

- Orders can be entered, amended, or canceled

- Orders can be kept in the system for up to 30 days

3. Pre-Close session

During the pre-close session:

- Auction mechanism to calculate the opening and closing price

- Orders can be canceled and order validity amended

- Order prices cannot be changed; quantities can be decreased but not increased

- New orders cannot be accepted

4. Market-Close session

During this state:

- The market is closed

- No action can be performed on any of the market symbols

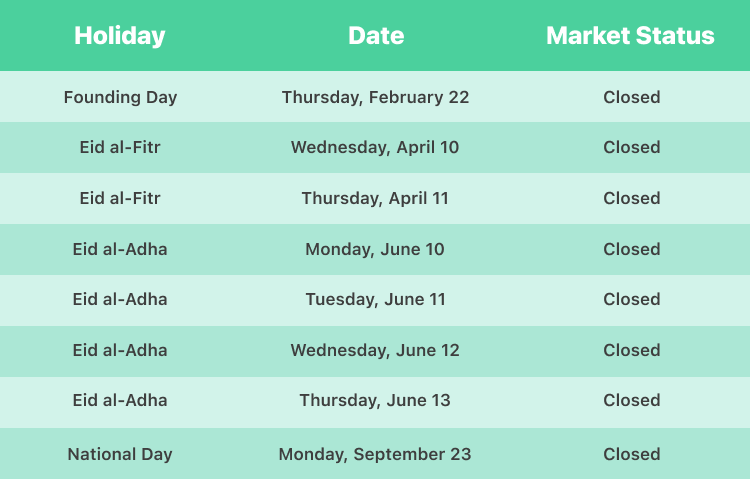

2024 Tadawul Market Holidays

Annual Official Holidays in the Kingdom of Saudi Arabia are:

- Saudi Founding Day 22 February

- Saudi Arabia National Day 23 September

- Eid Al-Fitr and Eid Al-Adha

The Saudi stock market is closed for eight holidays in 2024. As seen below:

Buy-in sessions in the Saudi exchange

1. 8:00 AM to 9:00 AM: Mandatory buy-in and optional buy-in /and optional sell-out orders. The order types are:

- All Mandatory Buy-in orders in this session must be market orders.

- Optional buy-in orders/ and optional sell-out orders may be either market orders or limit orders.

2. 9:00 AM – 9:30 AM: Exchange Members may submit orders to match the bid and offer submitted in the previous session, where the trades will be executed at the end of the auction at 9:30 am. All orders in this session must be limited orders.

3. 1:30 PM – 2:30 PM: Mandatory buy-in and optional buy-in /and optional sell-out orders, and the order types include:

- All mandatory buy-in orders in this session must be market orders.

- Optional buy-in orders /and optional sell-out orders may be either market orders or limit orders.

4. 2:30 PM – 3:00 PM: Exchange Members may place orders to match the bid and offer submitted in the previous session, where the trades will be executed at the end of the auction at 3:00 pm. All orders in this session must be limited orders. (Source from: www.saudiexchange.sa)

Opening & Closing auctions in the Saudi stock market

- The opening auction starts at 9:30 am and ends at 10:00 am. The market opening is randomized on a daily basis between 10:00:00 am and 10:00:30 am.

- The opening price is determined through an opening auction. During the opening auction, investors may place orders (bid/ask). The trading engine will determine an equilibrium price at which all possible matching orders are executed at the end of the auction. The execution price is the opening price.

- The closing auction starts after continuous trading (Market Open session) from 3:00 pm to 3:10 pm, and the closing price will be determined at the closing auction every day randomly between 3:10:00 pm and 3:10:30 pm. Here is how the closing price is determined for equities.

- The closing auction is a session after continuous trading where investors may place orders (bid/ask). The trading engine will determine an equilibrium price at which all possible matching orders are executed at the end of the auction. The execution price is the closing price and becomes the next day’s reference price.

- The closing price is calculated based on normal trades only, which are trades above SAR 15,000 in the Main Market and SAR 2,500 in Nomu – Parallel Market. If there are no trades during the auction, then the closing price is the last traded price (LTP) during continuous trading. If there are no trades during the day, the closing price is the previous day’s closing price. (Source from: www.saudiexchange.sa)

Trade-at-last session in the Saudi stock market

The trade-at-last session is an additional session after the closing auction where market participants may trade only at the closing price formed in the closing auction. It starts at 3:10 pm and ends at 3:20 pm for both Main Market and Nomu – Parallel Market, as well as tradable rights.

Fluctuation limits in the Saudi market

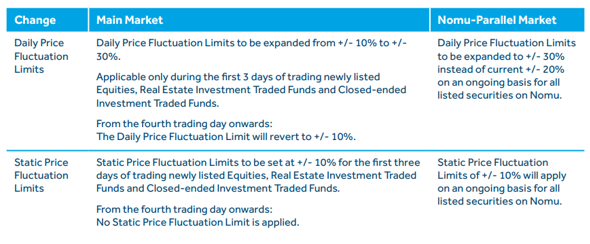

Tadawul only allows order execution on listed securities (except for Debt Instruments) at a price within the Daily Fluctuation Limits. The Exchange sets these limits against the reference price and they remain valid during the trading day. The reference price typically is the previous trading day’s closing price. Absent a previous closing price, the trading system uses the listing price as the reference price. The Tadawul exchange stipulated in a statement that newly listed stocks are allowed to rise or fall 30% in their first three days of trading, up from the current 10% limit. From the fourth day, the daily limits will revert to 10%. The following are fluctuation limit rules for both the Main Market and Nomu-Parallel Market:

- Daily price fluctuation limits: A daily price fluctuation limit is the maximum percentage, up or down, that an exchange-traded security is allowed to fluctuate in one trading day, currently at -/+ 10%.

- Static price fluctuation limits: Static price fluctuation limit is applied once the price of a security reaches 10% upwards or downwards. Once +/- 10% is reached, a volatility auction is triggered, and a new static limit is set based on the volatility auction reference price.