Date: September 5, 2024

Sahm Research Center: We have previously covered and researched NVIDIA. Following the release of their latest Q2 financial report, we have updated our views and investment outlook. Here are our latest insights:

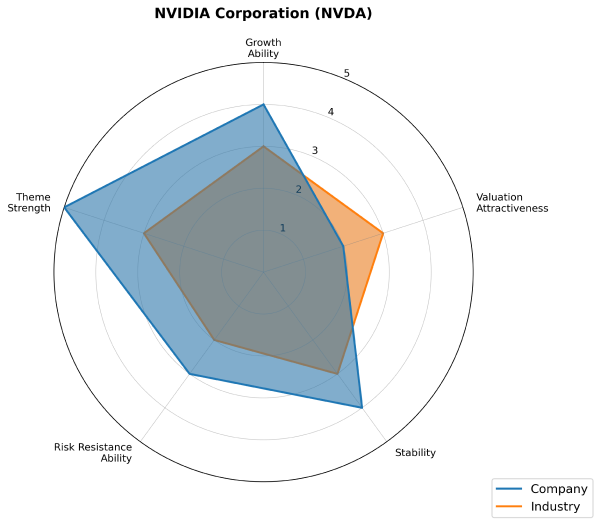

First, let’s take a look at Nvidia's valuation through our model.

Model Explanation: The model primarily evaluates companies and industries across five dimensions: growth ability, valuation attractiveness, stability, risk resistance ability, and theme strength. Each dimension is scored from 1-5, with 1 being the lowest and 5 the highest. Overall, higher scores indicate stronger fundamentals.

Here are the dimensions explained:

- Growth Ability: Measures future performance potential; higher growth rates yield higher scores.Valuation\

- Attractiveness: Assesses stock valuation; lower valuations earn higher scores.

- Stability: Evaluates the consistency of profit generation; greater stability means higher scores.

- Risk Resistance: Gauges the capacity to endure macroeconomic changes; better risk resistance leads to higher scores.

- Theme Strength: Rates market favor for the stock in the short term; increased favor results in higher scores.

Fundamental Analysis

1. Company Overview

Powering the AI revolution with cutting-edge graphics processing units (GPUs) and accelerating computing platforms across gaming, data centers, and autonomous vehicles.

2. Financial Insights

- Lastest Earnings Result

Q2 Results | Estimate | %Growth Change (Yoy) | |

Revenue | $30 Billion | $28.8 Billion | 122% |

EPS | $0.68 | $0.64 | 152% |

- Business Segments Performance: Data center revenue was $26.3 billion, a year-over-year increase of 154%, exceeding the expected $25.1 billion; gaming and AI PC business revenue was $2.9 billion, a year-over-year increase of 16%.

- Q3 Business Guidance: Revenue is expected to be $32.5 billion, with an estimated year-over-year increase of around 80%, lower than the buy-side analyst expectation of $33-35 billion; Q3 revenue growth will slow down to double digits for the first time.

- Share Repurchase: Nvidia announced a new $50 billion share repurchase program.

3. Growth Prospects

Based on MAG7's financial reports, the AI arms race is accelerating, with tech giants increasing their capital expenditures in AI. This trend is likely to continue in the medium term. Nvidia, as a key player in the AI chip market, has strong medium-term performance prospects and high barriers to entry, making it valuable in the capital market. Nvidia's CEO highlighted strong demand for Hopper and Blackwell, projecting billions in Q4 revenue, which eases investor concerns about potential Blackwell shipment delays.

4. Risks

The valuation is relatively expensive, with a price-to-earnings ratio of 72 times, which can hardly be considered cheap. The high valuation implies high expectations from investors, and the slightly lower-than-expected business guidance this time has triggered a fall in the stock price.

Technical Highlights

Due to an unexpected interest rate hike by the Bank of Japan in early August, Nvidia's stock dropped by 30%, although it remained above previous levels, maintaining an overall upward trend. However, the recent rebound failed to surpass the previous high of $140. If the stock turns downward, it may form a head and shoulders pattern, potentially testing the $90 neckline. Despite this, Nvidia's long-term fundamentals remain strong. A drop below the neckline during correction could present a buying opportunity.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.