In-Depth Equity Analysis: On Holdings (ONON.NYSE)

On Holdings (ONON.NYSE): Premium Sports Brand with Strong Growth Potential:

1. On originated in the Swiss Alps and was founded in 2010. On specializes in producing premium footwear, apparel and accessories for high-performance running, outdoor activities, training, all-day activities and tennis. Their product line includes various athletic shoes and sports equipment, such as running shoes, walking shoes, training shoes and outdoor shoes. On went public in the United States in 2021 with the ticker symbol ONON.

2. On positions itself as a premium sports brand, primarily targeting the middle class. Their best-selling running shoes are mostly priced above USD 150, with high-end products priced above USD 300. On is currently one of the rare premium sports brands in the market.

3. On has expanded rapidly in recent years, successfully entering markets in the Americas, EMEA region, and Asia-Pacific. The Americas currently represent On's largest market, while the Asia-Pacific region shows the fastest growth. On successfully turned profitable in 2022. By the end of 2023, On had over 10,000 retail partner stores and more than 30 DTC (Direct-to-Consumer) stores, with over half of its DTC stores located in China.

4. In terms of valuation, On's current P/E ratio is 105x, significantly higher than other comparable companies listed in the U.S. stock market. Although On's fundamentals are strong, the high valuation has likely priced in much of its future growth potential.

Source: ON Official Website

Investment Thesis:

1. The global sports footwear and apparel market is substantial, with a market size of USD 392.5 billion in 2023 and projected to reach USD 455 billion by 2026, representing a CAGR of 5% from 2023-2026. On's current market penetration remains low. Taking the U.S. market as an example, major players like Nike and Skechers dominate the majority of market share, while On's overall brand influence is still relatively limited. However, On has demonstrated strong growth potential with revenue growth exceeding 45% in each of the past three years, indicating significant room for market penetration in the future.

2. In terms of brand positioning, On targets the premium segment with higher-priced products that are almost always sold at full price. Even during the pandemic when supply chain disruptions led to high inventory levels, On rarely offered discounts. This strategy has helped maintain gross margins above 55%, higher than its competitors. The premium positioning also means their target customers are less price-sensitive, giving On strong pricing power.

3. On's core technology is robust, featuring patented innovations like CloudTec, Speedboard, and LightSpray that utilize lightweight technologies to reduce shoe weight while improving athletic performance and wearing comfort. Additionally, their fashionable designs enhance product competitiveness.

4. On has performed well in emerging markets, particularly in China. In Q3 2024, sales in the Asia-Pacific region grew 79% year-over-year, primarily driven by strong performance in the Chinese market. Currently, On's market penetration in China remains relatively low, suggesting significant potential for continued growth in the future.

5. On's apparel and accessories business currently accounts for a relatively small portion of total revenue, less than 5%. However, this segment has experienced rapid revenue growth in recent years, with a compound annual growth rate exceeding 50%. This segment has the potential to become a second growth driver for the company in the future.

6. On actively enhances its brand influence through various marketing strategies. On one hand, the brand boosts awareness through celebrity endorsements - in 2019, former tennis star Roger Federer joined On as both an investor and close partner, and the company has also signed various marathon and track and field athletes. On the other hand, On sponsors major sporting events - the brand sponsored the Swiss Olympic team's apparel for the 2020 Tokyo Olympics and launched their own athletic team, the On Athletics Club, in 2021. In terms of user marketing, On continuously promotes through social media platforms like Instagram and Twitter to expand its influence, while regularly organizing offline events such as SquadRace to engage with users and enhance customer loyalty.

Company History:

1. On was founded by former triathlon champion Olivier Bernhard and his friends Caspar Coppetti and David Allemann in 2010. The company specializes in producing premium athletic footwear, apparel, and accessories. The brand is positioned in the high-end market segment, targeting middle-class consumers.

2. In its early stages, the company focused on technological development, with its CloudTec patent representing an innovative cushioning technology. From 2013, On began gradual global expansion, entering the European, American, Japanese, and Chinese markets successively. In 2019, tennis star Roger Federer joined On as an investor and close partner. The company went public in the United States in 2021 under the ticker symbol ONON. By the end of 2023, On had established a network of over 10,000 retail stores and more than 30 direct-to-consumer (DTC) stores.

Business Model:

The overall product line consists of footwear, apparel, and accessories. Footwear is the absolute core product, accounting for over 95% of revenue in 2023, catering to various sports scenarios including trail running, hiking, tennis, and training. In terms of R&D, besides the original CloudTec technology, the company has developed other technologies including Speedboard, Helion, and Cyclon. While apparel and accessories currently represent a small portion of revenue, less than 5%, this segment has been experiencing rapid growth in recent years. Regarding sales channels, On primarily operates through a wholesale-dominated model supplemented by direct sales, including its own official online store. Moving forward, On plans to open more direct retail stores to enhance brand influence and improve consumer experience.

Source: ON Official Website

Financial Analysis:

1. In the first half of 2024, On achieved revenue of CHF 510 million, with year-over-year growth of 21%, and net profit of CHF 90 million. In terms of revenue distribution, the Americas is the largest market accounting for approximately 65%, EMEA region accounts for about 25%, and Asia-Pacific region about 10%. The Asia-Pacific region shows particularly high growth, with Q2 2024 revenue growth reaching 73%.

2. In Q3 2024, Gross margin improved to 60.6%, and adjusted EBITDA margin increased from 16.9% to 18.9%. Additionally, On's DTC channel share of total sales increased to 38.8%.

3. Recent financial reports show rapid revenue growth demonstrating strong growth potential, mainly driven by new market expansion and new product launches.

4. Regarding operational metrics, since its IPO, gross margin has gradually improved and maintained above 55%, ranking among the top among comparable companies. Net profit margin has shown significant fluctuation - while maintaining positive since 2022, quarterly variations remain substantial, mainly due to high volatility in various expense ratios.

5. From an expense ratio perspective, sales and administrative expenses remain high, maintaining around 50%, which is the main factor dragging down net profit margin. Sales expenses primarily cover athlete signing fees, sports team sponsorships, and various advertising and marketing expenditures.

6. Regarding assets and liabilities, cash and cash equivalents account for over 30% of total assets. On the liability side, the overall debt ratio is relatively low, with no significant debt pressure.

Risk Factors:

1. Exchange Rate Risk: Products are priced in Swiss francs, and fluctuations in the Swiss franc to US dollar exchange rate may pose currency risks.

2. Risk of Global Macroeconomic Downturn: The company may faces potential risks from poor global economic conditions.

3. Risk of Intensifying Industry Competition: The company may faces risks from increasing competition within the industry.

Research Report Appendix

Company Concept:

On was founded by former triathlon champion Olivier Bernhard and his friends Caspar Coppetti and David Allemann in 2010. The company specializes in producing premium athletic footwear, apparel, and accessories. The brand is positioned in the high-end market segment, targeting middle-class consumers.

Model Explanation:

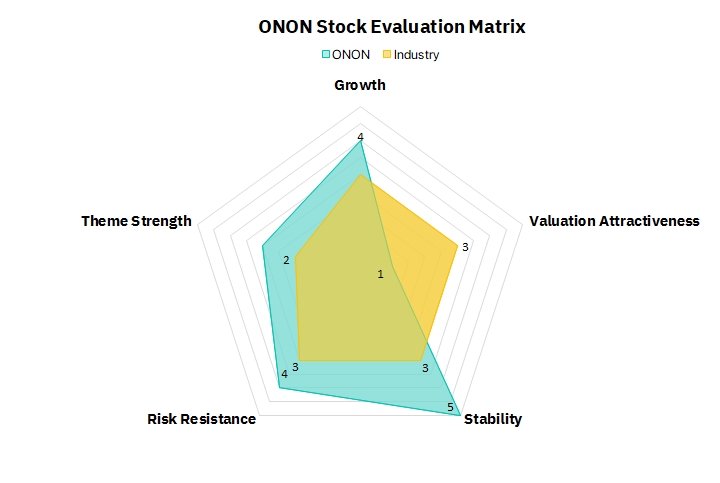

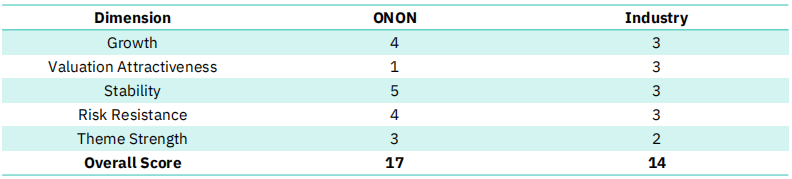

The model primarily evaluates companies and industries across five dimensions: growth ability, valuation attractiveness, stability, risk resistance ability, and theme strength. Each dimension is scored from 1-5, with 1 being the lowest and 5 the highest. Overall, higher scores indicate stronger fundamentals. For each dimension, a multi-factor model will be constructed based on industry and historical data of selected stocks, and a quantitative model will be used to automatically score each dimension.

Here are the dimensions explained:

- Growth Ability: Measures future performance potential; higher growth rates yield higher scores.

- Valuation Attractiveness: Assesses stock valuation; lower valuations earn higher scores.

- Stability: Evaluates the consistency of profit generation; greater stability means higher scores.

- Risk Resistance: Gauges the capacity to endure macroeconomic changes; better risk resistance leads to higher scores.

- Theme Strength: Rates market favor for the stock in the short term; increased favor results in higher scores.

Disclaimer:

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interest or conflict of interest with any stocks mentioned in this report.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.