An overview of Saudi Arabia's economy

The Saudi economy is an oil-based economy, one of the world's largest twenty economies (G20). Saudi Arabia has the second-largest proven petroleum reserves, accounting for 20% of the world's proven reserves, and is a major player in OPEC. Nowadays, Saudi Arabia is likely to be one of the fastest-growing economies in the world with sweeping pro-business reforms and a sharp rise in oil prices and production power recovery from a pandemic-induced recession in 2020.

Although the economic base continues to be dominated by oil, the Kingdom of Saudi Arabia has taken steps to diversify its economy and promote growth through privatization, for instance, electricity and telecommunications are already being privatized, while new economic cities are also being designed to encourage new developments outside of the energy industry. Besides, with the financial market of Saudi Arabia opened up, the equity market of Saudi Arabia also plays a significant role in its economy. Here is a look at the basic knowledge of Saudi Arabia’s stock market.

Getting to know the Saudi Arabia stock exchange

The Saudi Stock Exchange, or Tadawul, was formed as a joint stock company after receiving approval from the Council of Ministers on 19 March 2007. Its operations are supervised by the Capital Market Authority of Saudi Arabia (CMA). Tadawul acts as a securities exchange in the Kingdom of Saudi Arabia enabling companies to raise capital through offerings made on a platform and list their securities. Apart from listing services, Tadawul also provides cash trading, derivatives trading, market information, client relationship, and operational services. In addition, thanks to the successful IPO of Saudi Aramco, one of the world's largest listed companies in terms of market capitalization, Tadawul became amongst the largest exchanges globally by market capitalization of listed companies with approximately US$2.8 trillion as of September 2022. With more than 250 listed companies, the currently listed companies of Tadawul carry out insurance, pharmaceutical, banking, petrochemical, retail, and telecommunication activities, among others.

The structure of Saudi Arabia's stock market

Saudi Arabia stocks can be mainly divided into the Main Market and the Nomu Parallel Market, and both markets provide different entry points for companies to access the Main Market depending on their state of development.

1. Main market

Companies can access Tadawul’s main market through a public offering (IPO) and listing. As part of the offering the company can raise new capital and/or create liquidity for the existing owners or shareholders, and the Main Market requirements for listing and for conducting an offering include:

- Must be a joint stock company.

- The company has carried out its main business for at least 3 years.

- To offer at least 30% of the shares to the public.

- The aggregate value of the shares listed must be at least SAR 300 million.

- Obligation to disclose material developments, such as first, second, and third quarter financial statements, annual financial statements, etc.

2. Nomu-parallel market

Nomu is a parallel equity market with lighter listing requirements that serves as an alternative platform for growing companies that do not yet meet the requirements for the Main Market and look to raise capital and access the capital markets. This is an important channel that serves to further help diversify and deepen the capital markets. The requirements for listing and offering on Nomu are:

- Must be a joint stock company.

- The issuer must have been carrying on its main business for at least one year.

- To offer at least 20% of the shares to the public, or a minimum capital in the circulation of at least SAR 30 Million of share value.

- The total market cap of the company must be at least SAR 10 Million.

- Have at least 50 public shareholders at the time of listing.

- Obligation to disclose material developments, such as semiannual interim financial statements, annual financial statements, etc.

Through a listing on Nomu, small and medium size companies can access institutional and individual investors who satisfy several criteria and have investment experience. These investors together are called Qualified Investors. The range of institutional investors that can be accessed is therefore the same as for the Main Market. The range of individual investors that can be accessed is more restricted and limited to experienced investors only. Notably, once a company is listed on the Nomu parallel market for two years, it has the opportunity to transfer up to the Main Market.

3. OTC equity market

OTC was introduced in July 2014 to provide a formal trading platform for securities that had been suspended and/or delisted from the regular exchange (mainly including securities with accumulated losses of 20% or more of the company’s capital). The OTC market follows a T+2 settlement cycle.

What are the major Saudi Arabia indexes?

The Tadawul All Share, or TASI, is a market index that tracks the performance of the companies listed on the Saudi Stock Exchange. If you are looking to see how the Tadawul is performing, you would check the Tadawul All Share Index.

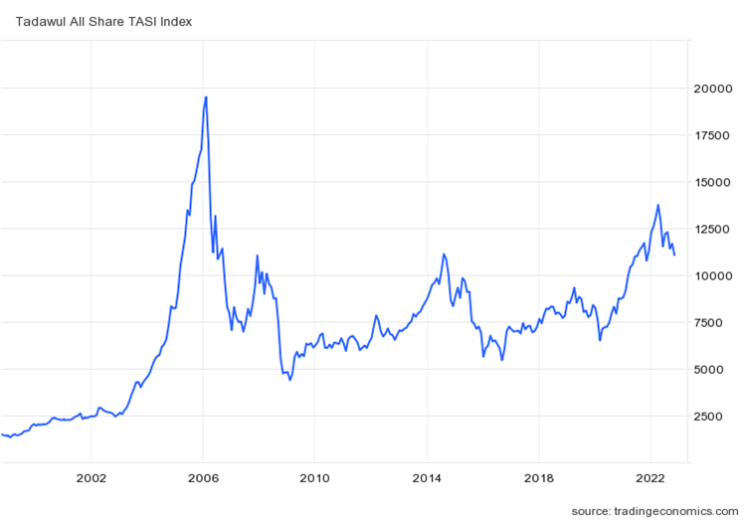

TASI is a capped index, meaning that it has a limit on the weight of any single security within the index to prevent any security from having a dominating influence on the index. The index was launched in 1985 with a base value of 1,000 and was restructured in 2008. The historic high of over 19,000 was reached in 2006 but has been trading in the range of 4,000 to 11,000 in recent years. In 2022, the index has steadily climbed well above 13,000 while movements are largely tied to oil price fluctuations. The details are shown in the chart below:

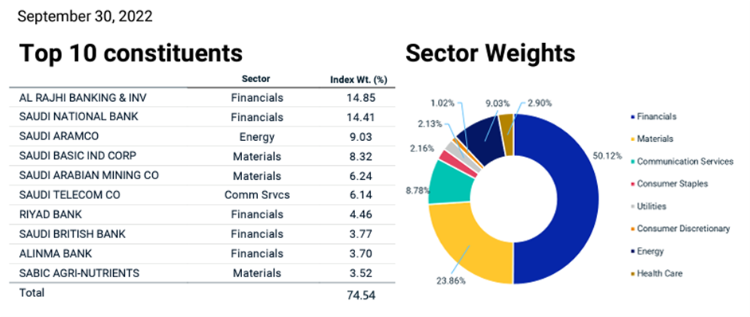

TASI has a variety of sectors each with their own weights. Its top five sectors and weights are estimated as financials at 40%, materials at 26%, communication at 11%, consumer staples at 6% and energy at 5%. Other sectors include consumer discretionary, health care, utilities, real estate, industrials and cash and/or derivatives.

In addition, the Saudi Stock Exchange (Tadawul) and MSCI Inc., a global leading provider of indices services, have partnered to develop a joint tradable index that can be used as a base for financial products including Derivatives and ETFs. The index is called MSCI TADAWUL 30 INDEX (or MT30). The MT30 Index represents the performance of approximately the 30 largest & most liquid securities listed in the Saudi equity market. The following are the top 10 constituents of the MT30 index:

Moreover, the securities’ weight has been capped at a 15% Capping Threshold to minimize the dominance of the largest cap securities in the Index.

Summary:

- Saudi Arabia is best known among investors for its tremendous oil industry, and it is one of the world's largest twenty economies.

- Although the economy of Saudi Arabia continues to be dominated by oil, the Kingdom of Saudi Arabia has taken steps to diversify its economy and promote growth through privatization.

- Saudi Arabia stocks can be mainly divided into the Main Market and the Nomu Parallel Market.

- Compared to the Main Market, Nomu is a parallel equity market with lighter listing requirements, which serves as an alternative platform for growing companies that do not yet meet the requirements of the Main Market.

- Once a company is listed on the Nomu parallel market for two years, it has the opportunity to transfer up to the Main Market.

- The Tadawul All Share, or TASI, is the major stock market index that tracks the performance of all companies listed on the Saudi Stock Exchange.