Please use a PC Browser to access Register-Tadawul

Nvidia Supplier Taiwan Semi Rides AI Wave to Record Rally, Sidestepping Geopolitical Concerns

Apple Inc. AAPL | 212.93 | +1.02% |

NVIDIA Corporation NVDA | 129.93 | +5.63% |

VanEck Vectors Semiconductor ETF SMH | 245.56 | +3.43% |

PHLX Sox Semiconductor Sector Ishares SOXX | 213.76 | +2.83% |

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR TSM | 193.99 | +3.75% |

Taiwan Semiconductor Manufacturing Co (NYSE:TSM) is experiencing a stock rally propelled by the artificial intelligence (AI) boom, overshadowing previous geopolitical worries.

Foreign investment in TSMC has surged to a two-year peak, with the company holding over a 90% market share in producing advanced semiconductors crucial for AI applications.

This shift in focus comes after Warren Buffett’s withdrawal last year due to geopolitical tensions related to Taiwan, which recently intensified with the election of a U.S.-friendly president, Lai Ching-te, viewed by Beijing as a provocateur, Bloomberg reports.

Also Read: Marvell’s Latest Tech Leap with TSMC – A 2nm Chip Platform Set to Transform AI Infrastructure

The semiconductor industry is in the early stages of an upcycle, bolstered by the critical role of advanced chips and TSMC’s dominance in the foundry market.

The company’s revenue increased by 9.4% in the first two months of the year, driven by the surge in AI activities, compensating for the slowing sales of Apple Inc (NASDAQ:AAPL) iPhones.

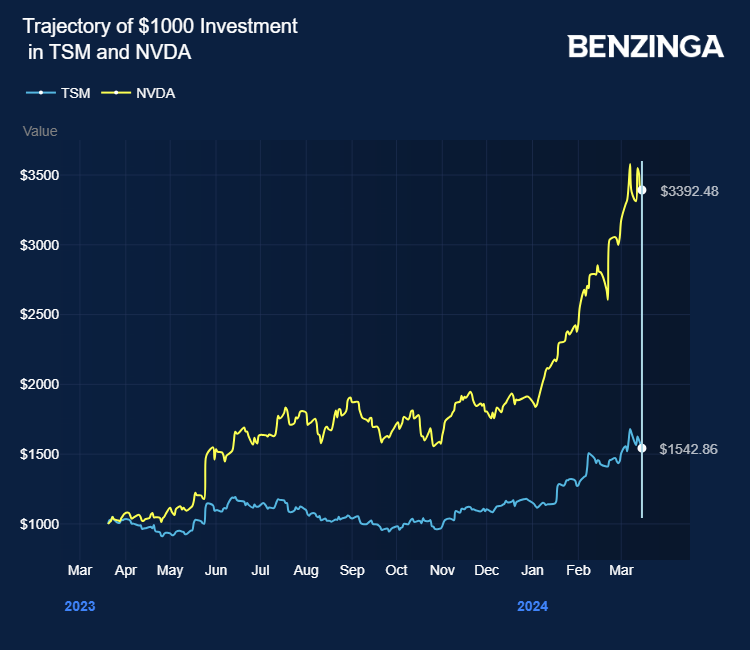

TSMC’s stock has more than doubled since October 2022, further fueled by the success of crucial client Nvidia Corp (NASDAQ:NVDA).

Experts and analysts express concerns about the sustainability of the AI-driven demand that has significantly boosted TSMC stock value. AI’s current contribution to TSMC’s revenue is relatively small at 6%.

They question the long-term feasibility of high investments in data centers. They are cautious about the company’s overstretched valuation due to its stock’s prolonged overbought status and premium over analyst targets.

Additionally, there needs to be more clarity regarding whether TSMC’s robust order book is driven by genuine demand for AI products or by American clients hedging against geopolitical risks and policy uncertainties amidst significant financial incentives from the U.S. under the Chips and Science Act.

To address market apprehensions regarding its concentration of chipmaking activities in Taiwan, TSMC is diversifying its manufacturing locations.

It announced a second fabrication plant in Japan and is constructing two advanced facilities in Arizona and one in Germany.

TSMC stock has gained 35% year-to-date versus Nvidia at 82%.

Investors can gain exposure to TSMC via VanEck Semiconductor ETF (NASDAQ:SMH) and IShares Semiconductor ETF (NASDAQ:SOXX).

Price Action: TSM shares traded higher by 0.89% to $138.20 premarket on the last check Monday.

Also Read: Taiwan Semi and Murata Join Apple in $280M Green Initiative

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock