Please use a PC Browser to access Register-Tadawul

US Market Preview | Gold Soars to New High! Micron Shares Surge 16% on Earnings, Nvidia-backed AI Startup Cohere Valuation Hits $5 Billion

Goldman Sachs Group, Inc. GS | 905.14 | +0.07% |

NVIDIA Corporation NVDA | 182.81 | -2.21% |

Micron Technology, Inc. MU | 411.66 | -0.56% |

Apple Inc. AAPL | 255.78 | -2.27% |

Key Takeaways

- Goldman Sachs Economist Projects Just 15% Chance of US Recession;

- Gold Soars to New High, Fed Rate Cut Expectations and Central Bank Buys Drive Demand;

- Nvidia-backed AI startup Cohere's Valuation Surges to $5 Billion with New Funding Round;

- Micron Technology Shares Surge on Stellar Q2 Revenue, Outperforms Expectations;

I. Market Report

Stock futures climbed Thursday morning after the three major averages closed at new records and the Federal Reserve concluded its latest policy meeting.

As of 08:22 am, EST (or 15:22 in Riyadh), futures tied to the Dow Jones Industrial Average added 115 points, or about 0.29%. S&P 500 futures advanced 0.48%, while Nasdaq 100 futures increased by about 0.98%.

II. Flash Headlines

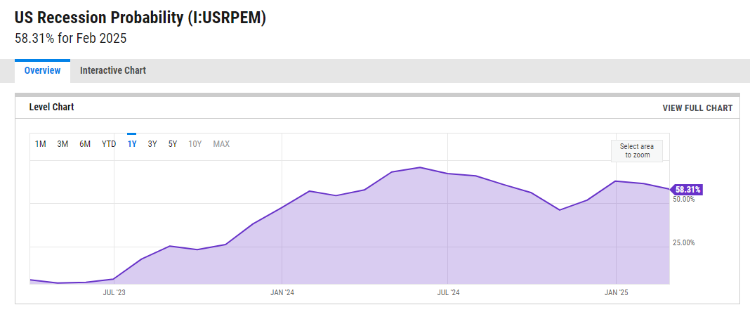

Goldman Sachs Economist Projects Just 15% Chance of US Recession

Jan Hatzius, Chief Economist at Goldman Sachs Group, Inc.(GS.US), estimates a low 15% risk of a US recession in the coming year.

With the Federal Reserve's aggressive rate hikes, the economic forecast is still promising due to subsiding inflation and strong growth indicators, aligning with investor expectations of hitting the Fed's 2% inflation goal soon.

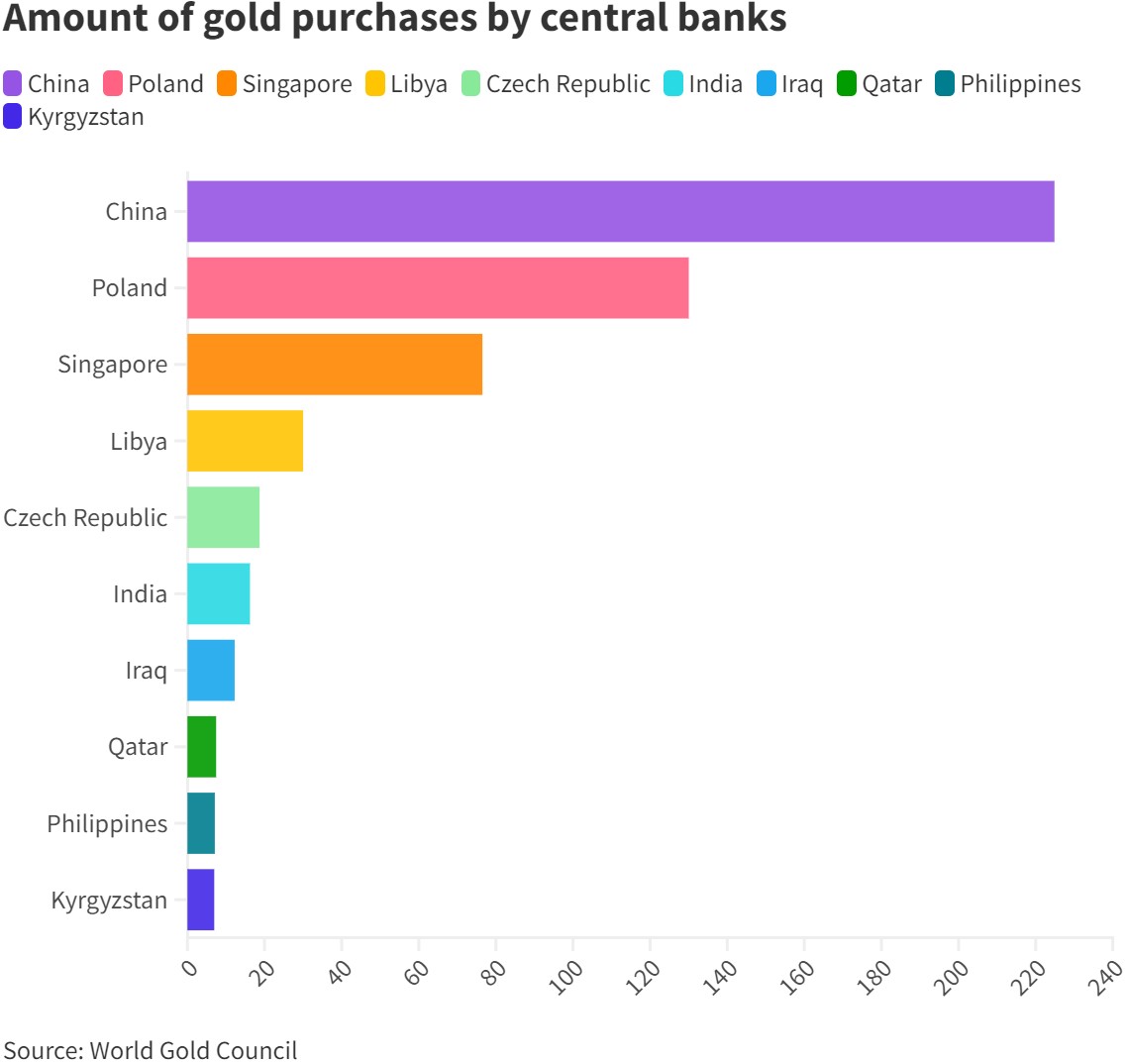

Gold Soars to New High, Fed Rate Cut Expectations and Central Bank Buys Drive Demand

Gold prices have hit a record high, crossing $2,223 an ounce amid market bets on up to three Federal Reserve rate cuts this year.

Following the Fed's decision to hold rates steady, spot gold and COMEX futures both soared, with the likelihood of a June rate cut now at 75%. Central banks continue to bolster their gold reserves, reaffirming its status as a safe-haven asset amidst global political tensions.

Fed Rate Cut Expectations Drive Copper to 11-Month High

As the Federal Reserve signals potential rate cuts, risk appetite heats up, softening the dollar and pushing copper prices to an 11-month peak. Copper has climbed over 10% in six weeks, fueled by supply risks and upbeat global economic outlooks. This week, the London Metal Exchange saw copper rise by 1.0% to US$9,080 per ton, while aluminum and iron ore also gained.

Nvidia-backed AI startup Cohere's Valuation Surges to $5 Billion with New Funding Round

AI startup Cohere, supported by NVIDIA Corporation(NVDA.US), is reportedly negotiating a major investment that could boost its valuation to $5 billion, a sharp increase from its previous valuation of $2.2 billion, according to Reuters.

III. Stocks To Watch

Micron Technology Shares Surge on Stellar Q2 Revenue, Outperforms Expectations

Pre-market trading saw Micron Technology, Inc.(MU.US) shares soared over 16% pre-market after a 57.7% revenue surge in fiscal Q2 to $5.82 billion, smashing the $5.35 billion forecast.

The company reversed losses with $204 million in adjusted operating profits, and it's fully booked on its High Bandwidth Memory product through 2025, predicting Q3 revenues to vastly outdo estimates.

Apple Hit with Antitrust Lawsuit Over iPhone Market Practices

Apple Inc.(AAPL.US) is reportedly being sued for purported breaches of US antitrust laws, accused of limiting competitors' access to iPhone technologies. The US Justice Department may bring the case to federal court imminently, intensifying the government's antitrust enforcement in the tech sector.

Cathie Wood's Ark Invest Sharply Increases Investment in Moderna

Ark Invest, led by Cathie Wood, has significantly bolstered its stake in biotech company Moderna, Inc., with the Ark Innovation ETF and Ark Genomic Revolution ETF acquiring 90,627 shares worth $9.34 million on Wednesday.

A Little Reminder:

Started on March 11th, the trading hours for USA stocks are adjusted as follows:

Pre-market trading hours will be from 11:00 to 16:30 in Saudi Arabia time; The regular trading hours will be from 16:30 to 23:00 in Saudi Arabia time; After-hours trading hours will be from 23:00 to 03:00 in Saudi Arabia time.